Balanced

July 2025

Click Here For Monthly Commentary

The Choice Capital Multi Asset Portfolios generated positive returns in July and delivered double-digit performance over the last twelve months, generally outperforming peer strategies over that period. Hyperion Australian Growth Companies and Eiger Australian Small Companies were the strongest performers in July, again thanks to excellent stockpicking.

At the opposite end of the spectrum, Resolution Capital Global Property Securities and Fairlight Global Small & Mid Cap detracted from returns as some of the funds’ positioning produced downside surprises. This looks likely to be a temporary aberration and we expect stronger performance in the second half of this year as conditions for listed property and small companies improve in the falling interest rate environment.

The beginning of the month saw the passing of the One Big Beautiful Bill Act, which reduces uncertainty around the funding of Trump’s domestic agenda while delivering further tax breaks. Overall, July was a strong month for equity markets. In fixed interest markets, global bond yields rose as investors noted steady economic data, while assessing the prospects of further increases in US government spending.

Looking ahead, US policy is likely to remain a key source of volatility for financial markets. A key risk is that the US cuts interest rates too soon, potentially coinciding with a period where inflation pressures intensify due to rising trade barriers. This could lead to higher yields if the economy shifts up a gear.

In Australia, confidence is rising and economic activity has improved in response to the RBA’s rate-cutting cycle. Markets are positioned for a further reduction at the November meeting. Recent monthly inflation data (which is more volatile) showed a larger-than-expected rise in prices during July, as households experienced a jump in their power bills.

Investment Approach

Based on the defensive / growth asset split of this Portfolio, we would regard this Portfolio as suitable for a MODERATE risk profile investor. If held for a 4 year timeframe (recommended minimum for this Portfolio), a Diversified Market Benchmark with this defensive / growth asset split would have delivered a best case return of 16.19% p.a., a worst case return of -1.43% p.a. and a negative annual return once in every 6.34 years (based on data from 1990 to 2023). Investors should expect more variability over periods shorter than the minimum recommended timeframe, emphasising the importance of holding the Portfolio for the recommended term.

3-4 years.

Investors should expect more variability over periods shorter than the minimum recommended timeframe, emphasising the importance of holding the Portfolio for the recommended term.

The Portfolio is invested across a mix of shares, property and fixed-income securities. The targeted use of specialist managers also allows access to investment expertise and a diverse range of securities not readily available in an individual portfolio of this size.

The objective of this Portfolio is to outperform Cash by a minimum of 3.25% with a solid level of income, a moderate level of capital growth and a moderately high level of capital volatility over an investment timeframe of 4 years. Other key objectives include outperforming both Competitor Funds and a Diversified Market Benchmark with less than or equal risk over the recommended timeframe. To achieve these objectives, the Portfolio typically invests 40.00% in defensive, income producing assets, with 60.00% exposure to growth assets.

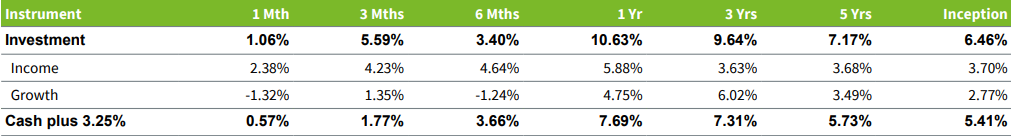

Net Returns

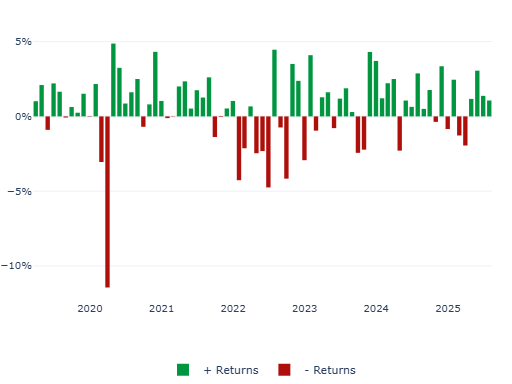

Monthly Returns

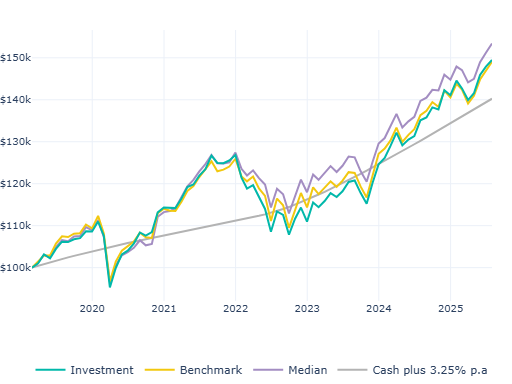

Growth of $100,000

Asset Allocation

.png?width=441&height=331&name=newplot%20(35).png)

Growth | Defensive

.png?width=441&height=331&name=newplot%20(36).png)

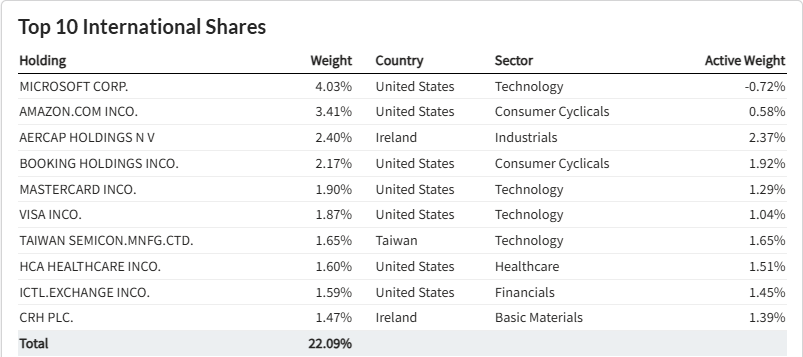

Underlying Holdings

The legal bit

Disclaimer:

Performance information contained in this report is an estimate based on portfolio allocations at the end of each month, individual client portfolio performance will differ. Total performance for the managed portfolio reflects the return after underlying fund manager investment fees for this managed portfolio but excludes the model manager fee, the responsible entity fee, the platform administration fee and any fee rebates provided to the investor by the underlying fund managers. Returns do not take into account tax payable.Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (Zenith) is the provider of General Advice (s766B Corporations Act 2001). To the extent that any information in this document constitutes advice, it is General Advice for Australian residents. This document has been prepared without taking into account the objectives, financial situation or needs of any specific person who may read it, including target markets of financial products, where applicable. It is not a specific recommendation to purchase, sell or hold any relevant product(s) and is subject to change at any time without prior notice. Investors should seek their own independent financial advice before making any investment decision and should consider the appropriateness of the information contained in this document in light of their own objectives, financial situation or needs. Investors should obtain a copy of, and consider, any relevant product PDS or offer document before making any decision. The information contained in this document has been prepared in good faith and is believed to be reliable, but its completeness and accuracy is not guaranteed. Zenith accepts no liability, whether direct or indirect arising from the use of information contained in this document or in relation to the inclusion of investment products that do not hold current ‘Zenith Approved’ or above Investment Rating or are not consistent with Zenith’s recommended asset allocation advice. Past performance is not an indication of future performance. Zenith’s Financial Services Guide is available at Financial Services Guide and full details regarding Zenith’s contact details, research processes, ratings information and conflicts of interest are available at Fund Research Regulatory Guidelines © 2020 Zenith Investment Partners. All rights reserved.